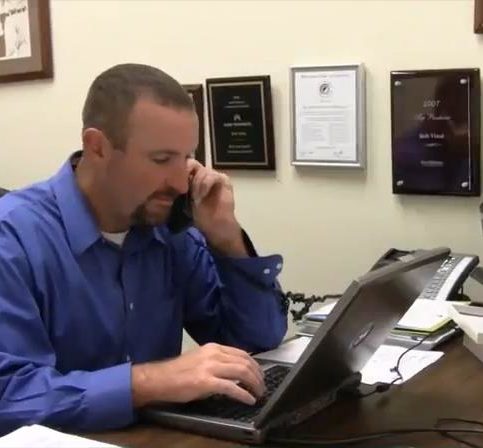

Bob Vinal: A Great Communicator

By James Florence, Diamond Certified Program Reporter

MENLO PARK — Following college, Bob Vinal wasn’t entirely sure how he would apply his communications degree in the professional realm, but after accepting a job offer in the insurance business, he found it to be a perfect fit. “My brother was selling life insurance and needed someone to help out with employee benefits,” he remembers. “As a communications major, I’ve always been one for gab, so when I got into insurance, I really enjoyed having the opportunity to talk with people on a daily basis.” After gaining further industry experience over the next few years, Bob decided to strike out on his own and founded Bay Area Health Insurance Marketing, Inc. in 1987.

A resident of Santa Cruz (where he lives with his wife, Trudy), Bob expresses his appreciation for the Bay Area’s characteristic attributes. “I love the weather and the people here—plus, as a sports fan, I love watching all the Bay Area teams.” Outside of work, some of Bob’s pastimes include coaching high school football, surfing, golfing, and barbecuing with friends and family. He also likes to keep in touch with his and Trudy’s three grown children: Therese, who works for the San Francisco Giants; Michelle, who is earning her master’s degree at Cal State Fullerton; and Matt, who recently graduated from University of Las Vegas.

In his life and career, Bob espouses the importance of treating others fairly and honestly. “Our main credos at Bay Area Health Insurance Marketing are to be honest with our clients and treat them as we’d want to be treated,” he affirms. “We don’t want to be the kind of brokers who make a profit at their clients’ expense; rather, we genuinely want to help our clients and give them good, sound advice.”

When asked the first thing he’d do if he were to retire tomorrow, Bob says he’d do some surfing, both at home and abroad. “Living in Santa Cruz, there’s plenty of good surfing, but I also like going to Hawaii, which is one of our favorite vacation spots. However, I know my wife wants to see some new places as well, so we’d probably do some more extensive traveling.”

Ask Me Anything!

Q: What’s your favorite sports team?

A: It depends on the time of year. During baseball season, it’s the San Francisco Giants; during football season, it’s the San Francisco 49ers; and during basketball season, it’s the Golden State Warriors.

Q: Are you a dog person or a cat person?

A: A dog person. I have two dogs, Bruschi and Bella.

Q: What were you most known for in high school?

A: I played football and was the rally commissioner.

Q: What’s your favorite snack?

A: Popcorn.

Q: What’s your favorite season?

A: Fall, because football starts.

Read moreRead less